Embarking on the journey of optimizing cloud spending requires a crucial decision: should you build your FinOps tooling in-house, or leverage pre-built solutions? This pivotal choice, known as the build vs. buy decision, shapes not only your financial strategies but also your operational efficiency and overall cloud management approach.

This guide provides a comprehensive exploration of this critical dilemma, offering insights into the fundamental concepts, requirements, and considerations that will empower you to make an informed decision. We’ll delve into the advantages and disadvantages of both approaches, examining factors like cost, time-to-market, and the expertise needed to succeed. Prepare to navigate the complexities of FinOps tooling with clarity and confidence.

Understanding the Core of Build vs. Buy in FinOps

The build vs. buy decision is a fundamental strategic choice in FinOps, shaping how organizations manage and optimize their cloud spending. This decision involves evaluating whether to develop custom FinOps tooling in-house (build) or to procure pre-built solutions from third-party vendors (buy). The optimal choice depends on a complex interplay of factors, and understanding these drivers is crucial for effective cloud financial management.

Fundamental Concepts Driving the Build vs. Buy Decision

The core of the build vs. buy decision revolves around resource allocation, strategic priorities, and the trade-offs between cost, control, and time. Organizations must weigh the benefits of tailoring a solution precisely to their needs against the efficiency and faster implementation offered by off-the-shelf products.

Advantages of Build vs. Buy for FinOps Tooling

Both building and buying FinOps tooling offer distinct advantages. The selection of either is based on the business needs.

- Build Advantages:

Building FinOps tooling provides granular control and customization. Organizations can tailor the solution to their specific requirements, integrating it seamlessly with existing infrastructure and workflows. This approach allows for a deeper understanding of the underlying data and logic. The ability to address unique business needs and the potential for intellectual property creation are additional benefits.

- Buy Advantages:

Purchasing FinOps tooling offers faster time-to-market and often lower initial costs. Vendors provide pre-built solutions that are readily deployable and often come with features like automated reporting, cost optimization recommendations, and integrations with various cloud providers. The vendor assumes responsibility for maintenance, updates, and support, freeing up internal resources to focus on core business activities.

Key Drivers Influencing the Decision

Several key drivers significantly influence the build vs. buy decision in FinOps. Each factor must be carefully assessed to determine the optimal approach.

- Cost:

The initial and ongoing costs of both build and buy options must be considered. Building requires investment in development, infrastructure, and ongoing maintenance. Buying involves subscription fees, which can vary depending on the features and scale. A thorough Total Cost of Ownership (TCO) analysis, factoring in labor, hardware, and software expenses, is crucial for making an informed decision.

TCO = (Initial Investment + Recurring Costs)

- Time-to-Market:

The speed with which a solution can be implemented is a critical factor. Buying FinOps tooling typically offers a faster time-to-market, as the solution is already developed and ready to deploy. Building requires time for development, testing, and deployment, which can delay the realization of FinOps benefits. For example, a company needing to rapidly gain insights into cloud spending might find buying a pre-built solution more advantageous.

- Internal Expertise:

The availability of internal expertise is a key consideration. Building requires a team with the necessary skills in cloud technologies, data analytics, and software development. Buying allows organizations to leverage the expertise of the vendor, reducing the need for in-house specialists. The level of expertise available will dictate which is the right choice.

- Integration Requirements:

The complexity of integrating the FinOps tooling with existing systems and workflows is important. If the organization has a complex and highly customized infrastructure, building may offer greater flexibility in integration. Buying may involve adapting existing workflows to align with the vendor’s solution.

- Scalability:

The ability of the solution to scale with the organization’s cloud usage is critical. Both build and buy options should be evaluated for their scalability. Buying from a reputable vendor often ensures that the solution can handle increasing data volumes and complexities. Building might require significant effort to scale as the organization grows.

- Security and Compliance:

Security and compliance requirements can influence the decision. Building allows for greater control over security measures, but it also places the responsibility for compliance on the organization. Buying from a vendor with established security certifications and compliance practices can streamline the process. For example, if an organization operates in a highly regulated industry, they may prioritize a vendor with proven compliance credentials.

Identifying the Needs: Defining FinOps Tooling Requirements

Before deciding to build or buy FinOps tooling, it’s crucial to clearly define your organization’s needs. This involves understanding the essential features of effective FinOps solutions and identifying the specific business challenges they address. A well-defined set of requirements will guide the decision-making process and ensure that the chosen tooling aligns with your organization’s strategic goals for cloud cost optimization and management.

Effective FinOps tooling goes beyond simple cost tracking; it provides actionable insights, automates processes, and fosters collaboration across teams. The features and functionalities described below are critical for achieving these goals.

Essential Features and Functionalities

The following features are generally considered essential for effective FinOps tooling:

- Cost Visibility and Allocation: This is the foundation of FinOps. The tooling must provide clear visibility into cloud spending, broken down by service, resource, team, and project. Detailed cost allocation enables accurate chargeback and showback processes.

- Reporting and Dashboards: Customizable dashboards and reports are essential for monitoring key performance indicators (KPIs), identifying trends, and communicating cost information to stakeholders. Reports should be easily shareable and support various levels of granularity.

- Anomaly Detection: Automated anomaly detection identifies unusual spending patterns that could indicate inefficiencies, misconfigurations, or unexpected usage. This allows for proactive intervention before costs escalate.

- Optimization Recommendations: The tooling should provide actionable recommendations for optimizing cloud resources, such as right-sizing instances, identifying idle resources, and leveraging reserved instances or savings plans.

- Budgeting and Forecasting: Tools should allow setting budgets, tracking spending against those budgets, and forecasting future cloud costs based on historical data and anticipated usage. Alerts should notify users when spending approaches or exceeds budget thresholds.

- Automation and Integration: Automation capabilities streamline FinOps processes, such as automated cost reporting, resource tagging, and the implementation of optimization recommendations. Integration with existing cloud provider APIs and other business systems is also critical.

- Collaboration and Workflows: Features that facilitate collaboration between engineering, finance, and operations teams are essential. This includes the ability to share cost data, assign ownership, and track the progress of optimization efforts.

Business Challenges Addressed by FinOps Tooling

FinOps tooling directly addresses several key business challenges related to cloud cost management:

- Lack of Cost Visibility: Without proper tooling, it’s difficult to understand where cloud spending is going, leading to wasted resources and uncontrolled costs.

- Inefficient Resource Utilization: Organizations often over-provision resources or fail to right-size them, resulting in unnecessary expenses.

- Budget Overruns: Without effective budgeting and forecasting, cloud spending can easily exceed allocated budgets, leading to financial strain.

- Difficulty in Identifying Optimization Opportunities: Manually identifying and implementing optimization recommendations is time-consuming and often ineffective.

- Siloed Teams and Lack of Collaboration: When engineering, finance, and operations teams don’t collaborate effectively, it’s difficult to align cloud spending with business goals.

- Compliance and Governance Issues: Cloud environments can be complex, making it challenging to ensure compliance with regulatory requirements and internal governance policies.

Common FinOps Use Cases and Tooling Requirements

The following table illustrates common FinOps use cases and the corresponding tooling requirements. It showcases how different aspects of FinOps are supported by specific functionalities.

| Use Case | Description | Tooling Requirement | Example Feature |

|---|---|---|---|

| Cost Allocation and Chargeback | Accurately attributing cloud costs to specific teams, projects, or business units. | Granular cost visibility, tagging capabilities, and reporting. | Detailed cost breakdown reports by team, with drill-down capabilities. |

| Anomaly Detection and Alerting | Identifying unusual spending patterns and alerting stakeholders. | Automated anomaly detection, custom alert thresholds, and notification systems. | Automated alerts triggered when spending on a specific service exceeds a predefined threshold. |

| Resource Optimization | Identifying and implementing opportunities to reduce cloud spending by optimizing resource utilization. | Right-sizing recommendations, idle resource detection, and reserved instance/savings plan recommendations. | Recommendations to switch from on-demand instances to reserved instances to reduce costs. |

| Budgeting and Forecasting | Setting budgets, tracking spending against those budgets, and forecasting future cloud costs. | Budgeting tools, forecasting models, and spending alerts. | Setting a monthly budget for a specific project and receiving alerts when spending approaches the budget limit. |

Evaluating the “Build” Option

Building FinOps tooling in-house offers a unique path to tailored solutions, but it’s a commitment that requires careful consideration. This section delves into the advantages and disadvantages of developing FinOps tools internally, examining the process and the resources required.

Potential Benefits of Building In-House

Choosing to build FinOps tooling provides several potential advantages, primarily centered around customization and control. These benefits can significantly impact how an organization manages and optimizes its cloud spending.

- Customization and Tailoring: In-house development allows for the creation of tools specifically designed to meet an organization’s unique needs and cloud infrastructure. This includes adapting to specific cloud providers, services, and reporting requirements. This flexibility often leads to more efficient and effective FinOps practices.

- Enhanced Control and Flexibility: Building in-house grants complete control over the tooling’s functionality, data access, and integration capabilities. This enables organizations to rapidly respond to changes in their cloud environment or business requirements. For example, a company experiencing rapid growth can adapt its FinOps tooling to accommodate new services or cloud providers quickly.

- Data Privacy and Security: Developing in-house allows organizations to maintain greater control over their cloud cost data, ensuring compliance with internal security policies and external regulations. Sensitive financial information remains within the organization’s control, reducing the risk of data breaches or unauthorized access.

- Integration with Existing Systems: In-house tools can be seamlessly integrated with existing systems, such as billing platforms, monitoring tools, and internal dashboards. This integration streamlines workflows and provides a unified view of cloud spending and performance.

- Cost Savings (Potentially): While initial investment can be high, in the long run, building in-house may result in cost savings compared to recurring subscription fees for commercial tools, especially for large organizations with complex needs. This is especially true when the tooling is well-maintained and evolves with the organization’s requirements.

Workflow for Developing and Deploying In-House FinOps Tools

Developing and deploying in-house FinOps tools involves a series of well-defined steps. This structured approach ensures a successful implementation and facilitates ongoing maintenance and improvement.

- Requirement Gathering and Analysis: The process begins with a thorough analysis of the organization’s FinOps needs, including cost visibility, optimization opportunities, and reporting requirements. This involves gathering input from stakeholders across various teams, such as finance, engineering, and cloud operations. The output of this phase is a detailed set of functional and non-functional requirements.

- Tool Design and Architecture: Based on the requirements, the tool’s architecture is designed, including data sources, data processing pipelines, and user interface (UI) elements. This stage defines the technical components and how they interact. Consideration is given to scalability, security, and maintainability.

- Development and Testing: The tool is developed based on the design, using appropriate programming languages and technologies. Rigorous testing, including unit tests, integration tests, and user acceptance testing (UAT), is conducted to ensure the tool functions as expected and meets the defined requirements.

- Deployment and Integration: The tool is deployed to a production environment, and integrations with existing systems are established. This stage involves configuring the necessary infrastructure, such as servers, databases, and cloud services.

- Monitoring and Maintenance: After deployment, the tool is continuously monitored to ensure its performance and availability. Regular maintenance, including bug fixes, security updates, and feature enhancements, is performed to keep the tool up-to-date and relevant.

- Iteration and Improvement: Based on user feedback and changing business needs, the tool is iteratively improved and enhanced. This involves gathering feedback, prioritizing new features, and continuously refining the tool to optimize its effectiveness.

Potential Challenges and Drawbacks of Building In-House

While building in-house offers advantages, it also presents significant challenges that must be carefully considered. These challenges can impact the project’s timeline, budget, and overall success.

- Resource Allocation: Building in-house requires a dedicated team of skilled developers, DevOps engineers, and potentially data scientists. Allocating these resources can be a significant challenge, especially for organizations with limited technical expertise or competing priorities. The team needs to be skilled in cloud technologies, data analysis, and software development best practices.

- Development Time and Cost: Developing FinOps tools from scratch can be time-consuming and expensive. The initial development phase, testing, and deployment can take months or even years, depending on the complexity of the tool and the size of the team. The ongoing maintenance and feature enhancements add to the total cost.

- Maintenance and Support: Maintaining and supporting in-house tools requires ongoing effort, including bug fixes, security updates, and performance optimization. This can be a significant burden, especially for organizations with limited IT resources. The team needs to be available to address issues and provide support to users.

- Lack of Expertise: Organizations may lack the specialized expertise required to build and maintain sophisticated FinOps tools. This can lead to inefficiencies, errors, and missed opportunities for cost optimization. Hiring or training the necessary expertise can be costly and time-consuming.

- Integration Challenges: Integrating in-house tools with existing systems and cloud providers can be complex, especially if the organization has a heterogeneous cloud environment. This requires significant effort and expertise to ensure seamless data flow and interoperability.

- Opportunity Cost: Investing in in-house tool development may divert resources from other strategic initiatives, such as product development or customer acquisition. Organizations need to carefully weigh the opportunity cost of building in-house against the potential benefits.

Evaluating the “Buy” Option: Selecting Third-Party Solutions

Purchasing pre-built FinOps solutions offers a streamlined path to cloud cost optimization. This approach leverages the expertise of vendors specializing in FinOps, providing tools and support to manage cloud spending effectively. Choosing the right third-party solution requires careful evaluation, considering various factors to ensure it aligns with your organization’s specific needs and goals.

Advantages of Purchasing Pre-built FinOps Solutions

Buying FinOps tools offers several benefits, making it an attractive option for many organizations. These advantages often lead to quicker implementation, reduced operational overhead, and access to specialized expertise.

- Faster Time-to-Value: Pre-built solutions are typically quicker to deploy and integrate than building in-house tools. This accelerates the time it takes to gain insights into cloud spending and implement cost-saving measures.

- Reduced Development Effort: Purchasing a solution eliminates the need for internal development teams to design, build, and maintain FinOps tools. This frees up valuable resources for other strategic initiatives.

- Access to Expertise: Vendors often have deep expertise in FinOps best practices and can provide guidance on optimizing cloud spending. This can lead to more effective cost management strategies.

- Ongoing Support and Updates: Vendors typically provide ongoing support, including bug fixes, security updates, and new feature releases. This ensures the solution remains up-to-date and effective.

- Scalability and Flexibility: Third-party solutions are often designed to scale with your cloud environment, adapting to changes in usage and complexity. They can also offer flexible pricing models and customization options.

Critical Factors for Evaluating Third-Party FinOps Tools

When selecting a third-party FinOps solution, a comprehensive evaluation process is essential. This process should consider several critical factors to ensure the chosen tool aligns with your organization’s requirements and delivers the expected value.

- Feature Set and Functionality: The tool should offer the features you need to manage your cloud costs effectively, including cost allocation, reporting, forecasting, anomaly detection, and optimization recommendations.

- Integration Capabilities: Assess the tool’s ability to integrate with your existing cloud providers (AWS, Azure, GCP), billing systems, and other relevant tools. Seamless integration is crucial for data accuracy and efficient workflow.

- Usability and User Interface: The tool should have an intuitive user interface that is easy to navigate and understand. Consider the learning curve for your team and the availability of training resources.

- Reporting and Analytics: The tool should provide robust reporting and analytics capabilities, allowing you to visualize your cloud spending, identify trends, and track the effectiveness of your cost optimization efforts.

- Pricing and Licensing: Understand the pricing model and licensing terms. Consider the total cost of ownership, including subscription fees, implementation costs, and ongoing maintenance expenses.

- Vendor Reputation and Support: Research the vendor’s reputation, customer reviews, and track record. Evaluate the level of support they provide, including documentation, training, and customer service.

- Security and Compliance: Ensure the tool meets your organization’s security and compliance requirements. This includes data encryption, access controls, and adherence to industry standards.

- Scalability and Performance: The tool should be able to handle the volume of data generated by your cloud environment and provide timely performance.

Comparison of Build vs. Buy in Different Areas

The following table provides a comparative overview of the pros and cons of building versus buying FinOps solutions, focusing on different key areas.

| Area | Build (In-House) | Buy (Third-Party) |

|---|---|---|

| Time to Implementation | Long (Months to Years) | Short (Days to Weeks) |

| Cost (Initial) | Potentially Lower (Initial Development) | Higher (Subscription Fees, Implementation) |

| Cost (Ongoing) | Higher (Maintenance, Updates, Staffing) | Potentially Lower (Vendor Responsibility) |

| Expertise Required | High (FinOps, Development, Cloud) | Lower (Vendor provides expertise) |

| Customization | High (Tailored to specific needs) | Limited (Vendor’s features) |

| Integration | Potentially Difficult (Internal Development) | Easier (Pre-built integrations) |

| Scalability | Potentially Limited (Depends on resources) | High (Designed to scale) |

| Support and Maintenance | Internal Responsibility | Vendor Responsibility |

Cost Analysis: Comparing Total Cost of Ownership (TCO)

Understanding the financial implications of building versus buying FinOps tooling requires a deep dive into the Total Cost of Ownership (TCO). This analysis provides a comprehensive view of all costs associated with each option, helping organizations make informed decisions that align with their financial goals and resource constraints. A well-executed TCO analysis moves beyond the initial purchase price or development cost to encompass the entire lifecycle expenses.

Calculating Total Cost of Ownership (TCO)

The TCO represents the total cost incurred over the entire lifespan of a FinOps tooling solution, whether built in-house or purchased from a vendor. It’s essential to calculate the TCO accurately to determine the most cost-effective option. The process involves identifying and quantifying all relevant costs, both direct and indirect, over a defined period (typically 3-5 years).The core formula for TCO is:

TCO = Direct Costs + Indirect Costs

Cost Components in a TCO Analysis

A thorough TCO analysis includes a wide array of cost components. Failure to consider all relevant costs can lead to an inaccurate comparison and a potentially costly decision. These components are categorized below:

- Direct Costs: These are the readily identifiable costs directly associated with the solution.

- Development Costs (Build): This encompasses salaries of developers, project managers, and other personnel involved in building the tool. Also included are the costs of software licenses (e.g., for IDEs, testing tools), hardware infrastructure (servers, storage), and any third-party libraries or services used during development.

- Purchase Price/Subscription Fees (Buy): This is the initial cost or ongoing subscription fees charged by the vendor for the FinOps tooling.

- Implementation Costs (Both): This covers the expenses of setting up and deploying the tool, including configuration, data migration, and integration with existing systems. This may include internal staff time or external consulting fees.

- Indirect Costs: These are the less obvious, often recurring costs that can significantly impact the TCO.

- Maintenance and Support Costs (Both): These expenses include ongoing maintenance, bug fixes, security updates, and technical support. For built solutions, this often involves the salaries of dedicated support staff. For purchased solutions, it’s the support fees charged by the vendor.

- Training Costs (Both): This involves the costs of training employees to use and maintain the tool. This can include internal training, vendor-provided training, or external training courses.

- Infrastructure Costs (Build): This includes the ongoing costs of running and maintaining the infrastructure that the tool relies on, such as servers, storage, and network costs.

- Opportunity Costs (Both): This represents the value of alternative uses of resources. For example, the time spent by internal staff on building or maintaining the tool could have been used for other, potentially more valuable, projects.

- Upgrade Costs (Both): This covers the expenses associated with upgrading the tool to newer versions, which might involve additional licensing fees, consulting services, and potential downtime.

- Security Costs (Both): These costs involve measures to ensure the security of the tool and the data it handles, including security audits, penetration testing, and security software.

Numerical Example: TCO Comparison

Let’s consider a simplified example comparing building versus buying a FinOps tool over a 3-year period.

| Cost Component | Build Option | Buy Option |

|---|---|---|

| Development/Purchase Cost | $100,000 (Year 1) | $30,000 (Annual Subscription) |

| Implementation Costs | $10,000 (Year 1) | $5,000 (Year 1) |

| Maintenance & Support | $30,000 (Annually) | $6,000 (Annually) |

| Infrastructure Costs | $15,000 (Annually) | $0 |

| Training Costs | $5,000 (Year 1) | $2,000 (Year 1) |

| Upgrade Costs | $10,000 (Year 2) | $3,000 (Year 2) |

| Total Cost (3 Years) | $280,000 | $124,000 |

Assumptions:

- Development cost for the build option includes salaries, software licenses, and initial infrastructure setup.

- The purchase cost for the buy option is an annual subscription fee.

- Implementation costs include internal resources and, in the buy option, some vendor support.

- Maintenance and support for the build option include internal staff salaries and infrastructure maintenance; for the buy option, it’s the vendor support fees.

- Infrastructure costs are only applicable for the build option, as the vendor handles this in the buy option.

- Training costs cover initial training and ongoing training to keep the team up to date.

- Upgrade costs are the estimated costs to update the tool over the three years.

This example demonstrates that, in this scenario, buying the FinOps tool is significantly more cost-effective over three years. However, the specific costs and the resulting TCO will vary greatly depending on the specific needs of the organization, the complexity of the tool, and the vendor selected.

Time-to-Market Considerations

The speed at which a FinOps solution can be implemented and start delivering value is a critical factor in the build vs. buy decision. Organizations often face pressure to optimize cloud spending quickly, and delays in tooling implementation can lead to continued overspending and missed opportunities for cost savings. Time-to-market directly impacts the return on investment (ROI) and the overall success of a FinOps initiative.

Speed of Implementation

The implementation timeline for FinOps tooling significantly differs between building and buying. Choosing the right approach involves a careful assessment of internal resources, technical expertise, and the urgency of the need for cost optimization. A shorter time-to-market allows for faster realization of benefits and a quicker impact on cloud spending.To illustrate the implementation differences, consider the following timelines:

- Building a Custom Solution: Building a custom FinOps tool typically involves a longer implementation period. This is due to the need for development, testing, and integration.

- Buying a Third-Party Solution: Purchasing a pre-built FinOps tool often allows for a quicker implementation. This is because the software is already developed and ready to be deployed.

The following timelines highlight the typical phases and durations for each approach:

Build Approach Timeline

Building a custom FinOps solution requires significant upfront investment in time and resources. The following is a general estimate:

- Requirement Gathering and Design (4-8 weeks): This phase involves defining the specific needs of the organization, selecting the appropriate cloud services to monitor, and designing the architecture of the custom tool. This also includes defining the scope and functionality, such as reporting needs, alerting, and integration requirements.

- Development and Testing (12-24 weeks): The core functionality of the tool is developed during this phase. This includes writing code, setting up data pipelines, building user interfaces, and rigorous testing to ensure accuracy and reliability. This stage can be prolonged if the tool is complex and if the team encounters unexpected challenges.

- Deployment and Integration (4-8 weeks): The tool is deployed into the production environment and integrated with existing systems. This includes configuring the tool to connect to the cloud provider’s APIs, setting up data collection and storage, and integrating with existing monitoring and alerting systems.

- Ongoing Maintenance and Updates (Continuous): After deployment, the tool requires ongoing maintenance, including bug fixes, security updates, and feature enhancements. This is an ongoing process.

Buy Approach Timeline

Purchasing a third-party FinOps solution typically results in a shorter implementation timeline. The following is a general estimate:

- Vendor Selection and Evaluation (2-4 weeks): This phase involves researching and evaluating different FinOps vendors, comparing features, pricing, and support options. It also includes proof-of-concept (POC) testing to validate the tool’s capabilities.

- Configuration and Setup (2-6 weeks): The chosen tool is configured to meet the specific needs of the organization. This includes connecting to the cloud provider’s APIs, configuring data collection, and setting up user accounts and access controls. This phase can vary depending on the complexity of the environment and the integration requirements.

- Training and Onboarding (1-3 weeks): Users are trained on how to use the tool, interpret the data, and generate reports.

- Ongoing Support and Optimization (Continuous): The vendor provides ongoing support, including bug fixes, feature updates, and assistance with optimization efforts.

It is important to note that these timelines are estimates and can vary based on the complexity of the project, the size of the organization, and the availability of resources. Organizations should carefully consider these factors when making the build vs. buy decision and prioritize solutions that can deliver value quickly.

Resource Allocation: Skills and Expertise Requirements

Deciding whether to build or buy FinOps tooling significantly impacts the required resource allocation. A thorough understanding of the skills and expertise needed, along with the challenges of talent acquisition and retention, is crucial for making an informed decision. Effective resource planning ensures that the chosen FinOps strategy is sustainable and delivers the expected benefits.

Identifying the Skills and Expertise Needed

Both building and buying FinOps tooling demand specific skill sets, although the nature and focus of these skills differ.

- For Building In-House Tooling: This approach necessitates a team with a broad range of expertise.

- Cloud Infrastructure Engineers: Proficient in cloud platforms (AWS, Azure, GCP) and their respective services. They are responsible for understanding resource usage, cost allocation, and optimization opportunities.

- Software Developers/Engineers: Skilled in programming languages (Python, Java, etc.) and familiar with building and maintaining applications, APIs, and data pipelines. They build and integrate the FinOps tooling.

- Data Engineers/Scientists: Capable of managing, analyzing, and visualizing large datasets related to cloud costs and usage. They design and implement data models, data warehousing solutions, and reporting dashboards.

- DevOps Engineers: Experts in automating the build, test, and deployment processes. They ensure the FinOps tooling is integrated into the CI/CD pipeline and properly managed.

- Financial Analysts/Cost Managers: Possessing a strong understanding of financial principles and cloud cost management. They interpret cost data, identify trends, and provide financial insights.

- FinOps Practitioners: With knowledge of FinOps principles, best practices, and the ability to translate business requirements into technical solutions. They bridge the gap between technical and financial teams.

- For Buying Third-Party Solutions: While building in-house demands a broad set of technical skills, buying FinOps tooling shifts the focus to vendor management and data analysis.

- FinOps Practitioners/Cloud Cost Managers: Understanding FinOps principles, the functionalities of the chosen tool, and how to apply them to optimize cloud spending.

- Data Analysts/Business Intelligence Analysts: Proficient in analyzing the data provided by the tool, generating reports, and identifying cost-saving opportunities.

- Vendor Managers: Responsible for managing the relationship with the vendor, negotiating contracts, and ensuring the tool meets the organization’s needs.

- Cloud Architects/Engineers: Possessing an understanding of the cloud environment to provide context for cost data and ensure the tool is properly integrated.

- Security Professionals: To ensure data security and compliance within the FinOps tool environment.

Challenges of Acquiring and Retaining Talent

Acquiring and retaining the necessary talent for either building or buying FinOps tooling can be challenging.

- High Demand and Competition: The demand for skilled cloud professionals, particularly those with FinOps expertise, is high. Organizations face intense competition from other companies, making it difficult to attract and retain top talent.

- Skill Gaps: Finding individuals with the combined technical and financial expertise required for FinOps roles can be difficult. Training and upskilling existing employees are often necessary.

- Retention Issues: High turnover rates are common in the tech industry. Organizations must offer competitive salaries, benefits, and opportunities for professional development to retain employees.

- Vendor Dependence: Relying on a third-party vendor can create dependence on their expertise and support, which might lead to vendor lock-in or difficulties if the vendor’s service or pricing changes.

- Rapid Technological Change: The cloud landscape is constantly evolving. Keeping up with the latest technologies and best practices requires continuous learning and adaptation.

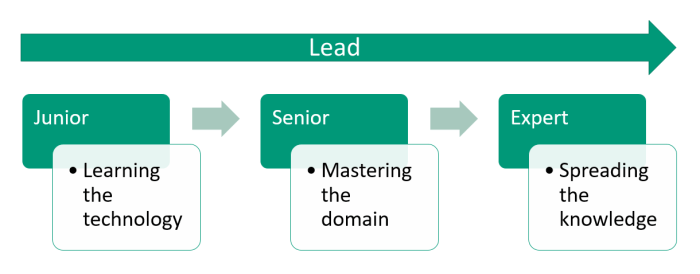

Examples of Team Structures

The structure of a FinOps team varies depending on whether the organization builds or buys its tooling.

- In-House Development Team Structure:

- FinOps Lead: Oversees the entire FinOps initiative, sets the strategy, and ensures alignment with business goals.

- Cloud Infrastructure Engineers: Responsible for cloud resource management, optimization, and cost allocation.

- Software Development Team: Develops and maintains the FinOps tooling, including data pipelines, APIs, and user interfaces.

- Data Engineers/Scientists: Designs and manages the data infrastructure for cost analysis and reporting.

- Financial Analyst/Cost Manager: Analyzes cost data, provides insights, and creates financial reports.

- DevOps Engineer: Manages the deployment and automation of the FinOps tooling.

- Vendor Management Team Structure:

- FinOps Lead/Cloud Cost Manager: Manages the FinOps strategy, the FinOps tool, and cost optimization initiatives.

- Data Analyst/Business Intelligence Analyst: Analyzes data from the FinOps tool and generates reports.

- Vendor Manager: Manages the relationship with the FinOps tool vendor, including contract negotiations and support.

- Cloud Architect/Engineer: Provides technical expertise on the cloud environment and integration of the FinOps tool.

- Finance Team Representative: Collaborates with the FinOps team to integrate cost data into financial reporting and planning.

Scalability and Flexibility

The dynamic nature of cloud environments and the ever-evolving landscape of cost optimization strategies necessitate that FinOps tooling be both scalable and flexible. This ensures that your FinOps practices can adapt to changing business needs, fluctuating cloud consumption, and the introduction of new technologies. The ability to scale and adapt is crucial for maintaining effective cost management and maximizing the value derived from cloud investments.

Adapting to Evolving Cloud Environments

Cloud environments are constantly changing. New services are released, existing services evolve, and usage patterns shift. FinOps tooling must be capable of keeping pace with these changes to remain effective. This involves the ability to ingest and process data from new cloud services, adjust to changes in pricing models, and support the implementation of new cost optimization strategies.The adaptability of FinOps tooling to evolving cloud environments can be evaluated through these aspects:

- Integration with New Services: The tooling should seamlessly integrate with new cloud services as they are introduced. This includes the ability to collect cost and usage data, apply relevant tagging and categorization, and incorporate these services into cost allocation and optimization reports.

- Support for Changing Pricing Models: Cloud providers regularly update their pricing models. The tooling must be able to accommodate these changes, automatically updating calculations and forecasts to reflect the new pricing structures. This might involve dynamic updates to the pricing engine or the ability to ingest pricing data from external sources.

- Handling Data Volume: Cloud environments generate vast amounts of data. The tooling must be able to handle this volume without performance degradation. This often involves using scalable data storage and processing technologies, such as data lakes or distributed processing frameworks.

- Real-time Data Processing: The ability to process data in real-time is increasingly important for timely cost optimization. The tooling should support real-time data ingestion, analysis, and alerting, allowing for immediate responses to cost anomalies or optimization opportunities.

Supporting Scaling and Adaptation to Business Needs

As a business grows, so too does its cloud footprint and the complexity of its FinOps requirements. The FinOps tooling must be able to scale to accommodate this growth, both in terms of data volume and the number of users. It should also be flexible enough to adapt to changing business needs, such as the introduction of new cost allocation models or the need for more granular reporting.The ability of FinOps tooling to support scaling and adaptation to business needs is characterized by these key features:

- Scalability of Data Processing: The system must be able to process increasingly large volumes of data without impacting performance. This can be achieved through distributed processing, horizontal scaling of compute resources, and efficient data storage.

- User Management and Role-Based Access Control: As the number of users increases, robust user management and role-based access control (RBAC) are essential. This ensures that users only have access to the data and functionality they need, enhancing security and simplifying administration.

- Customization and Extensibility: The ability to customize the tooling to meet specific business requirements is critical. This might involve the ability to create custom dashboards, reports, or alerts. Extensibility through APIs or plugins allows integration with other business systems.

- Integration with Other Business Systems: FinOps tooling should integrate with other business systems, such as accounting, budgeting, and project management tools. This integration streamlines workflows and provides a more holistic view of cloud costs.

Examples of Tooling Approaches

Different approaches to FinOps tooling, whether build or buy, offer varying degrees of scalability and flexibility. The choice depends on the specific needs of the organization and its FinOps maturity level.

- Build Option: A custom-built FinOps solution offers the highest degree of flexibility. It can be tailored precisely to the organization’s needs, allowing for the integration of unique data sources and the implementation of highly customized cost optimization strategies. However, building a solution requires significant investment in engineering resources and ongoing maintenance. The scalability depends on the design and implementation of the solution, using technologies like serverless computing or container orchestration for scaling.

- Buy Option: Third-party FinOps tools often provide a more readily available solution with varying degrees of scalability and flexibility. These tools typically offer pre-built integrations with major cloud providers, a range of cost optimization features, and user-friendly dashboards.

- Scalable Solutions: Many commercial FinOps tools are designed to scale horizontally, using cloud-native technologies to handle large volumes of data. These tools often offer features like auto-scaling and high availability to ensure continuous operation.

- Flexible Solutions: Some tools offer extensive customization options, such as the ability to create custom reports, dashboards, and alerts. They may also provide APIs for integration with other systems. The flexibility of the solution often depends on the vendor and the features included in the chosen plan.

Integration and Interoperability

Seamless integration and interoperability are critical factors in the success of any FinOps implementation. The ability of FinOps tooling to connect with existing cloud platforms, IT systems, and other relevant tools determines its effectiveness in providing accurate insights, automating cost optimization, and streamlining financial management processes. Ignoring integration needs can lead to data silos, manual processes, and ultimately, a less efficient and less valuable FinOps practice.

Connecting with Existing Systems

The value of FinOps tools is greatly enhanced by their ability to integrate with a wide range of systems. This connectivity allows for the aggregation of data from diverse sources, enabling a holistic view of cloud spending and resource utilization.

- Cloud Provider Platforms: FinOps tools must seamlessly integrate with the major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). This integration enables the ingestion of cost and usage data directly from these platforms, which is the foundation for all FinOps activities. This includes pulling in data on services used, instances running, and associated costs.

- IT Systems and Infrastructure: Integration with existing IT systems, such as configuration management databases (CMDBs), asset management systems, and monitoring tools, provides valuable context to cloud cost data. For instance, correlating cloud spending with specific applications or business units can be achieved through CMDB integration.

- Financial Systems: Connecting with financial systems, including accounting software and ERP systems, is essential for budgeting, forecasting, and chargeback/showback processes. This integration ensures that cloud costs are accurately reflected in financial reports and that cloud spending aligns with overall financial strategies.

- Collaboration and Communication Tools: Integration with tools like Slack, Microsoft Teams, and email allows for real-time alerts, notifications, and collaborative workflows related to cloud cost management. For example, automated notifications can alert teams when spending exceeds pre-defined thresholds.

- Data Warehouses and Business Intelligence (BI) Tools: Integrating with data warehouses (e.g., Amazon Redshift, Google BigQuery, Snowflake) and BI tools (e.g., Tableau, Power BI) allows for advanced analytics, custom reporting, and data visualization. This is particularly useful for creating custom dashboards and reports tailored to specific business needs.

Integration Capabilities Offered by Different FinOps Tooling Options

The integration capabilities vary significantly between build-your-own (BYO) solutions and commercial FinOps tools. Understanding these differences is crucial for making an informed build vs. buy decision.

- Build-Your-Own Solutions: BYO solutions offer high flexibility in terms of integration. Custom integrations can be developed to connect with any system, but this requires significant development effort and expertise.

- Pros: Full control over integration methods, ability to tailor integrations to specific needs, and no reliance on vendor-provided integrations.

- Cons: Requires significant development resources, ongoing maintenance, and the need to stay current with evolving cloud provider APIs and system updates.

- Commercial FinOps Tools: Commercial tools typically offer pre-built integrations with popular cloud providers, IT systems, and financial systems. They often provide a user-friendly interface for configuring and managing these integrations.

- Pros: Ready-made integrations, reduced development effort, easier to set up and maintain, and vendor-provided support for integrations.

- Cons: Limited flexibility in terms of customizing integrations, potential reliance on vendor roadmaps, and the possibility of integration limitations with niche systems.

- Integration Methods: Common integration methods include APIs, webhooks, and data connectors. APIs (Application Programming Interfaces) are used to exchange data between systems. Webhooks provide real-time notifications of events. Data connectors facilitate the transfer of data from various sources.

Architecture of a FinOps Solution Emphasizing Integrations

The architecture of a FinOps solution should be designed with integrations in mind. The following diagram illustrates a common architecture:

Diagram Description: The diagram illustrates a layered architecture of a FinOps solution, highlighting key integrations. At the bottom, the diagram displays three main cloud providers: AWS, Azure, and GCP. Each cloud provider has a direct connection (represented by a line) to the “Cost and Usage Data Ingestion” layer.

This layer is responsible for collecting and processing cost and usage data from each cloud provider. Above this, the diagram shows the “Data Storage and Processing” layer, where the ingested data is stored and processed. This layer is connected to the “Cost Optimization Engine” layer, which uses the processed data to provide recommendations and automate cost-saving actions. The “Cost Reporting and Analytics” layer is also connected to the “Data Storage and Processing” layer and provides insights and reports.

Furthermore, the diagram illustrates integrations with various external systems: IT Systems (CMDB, Monitoring Tools), Financial Systems (Accounting, ERP), Collaboration Tools (Slack, Teams), and BI Tools (Tableau, Power BI). Each of these systems has a connection to the appropriate layers (Data Storage and Processing, Cost Reporting and Analytics, or Cost Optimization Engine), depending on the data exchange and workflow. The entire architecture is connected to the “User Interface” layer, which provides access to the FinOps platform’s features and functionalities.

The connections between layers are represented by lines, indicating the flow of data and the relationships between the components. This architecture emphasizes the importance of data flow and integration between different systems to achieve effective FinOps practices.

+---------------------+ +-----------------------------------+ +-----------------------------------+ | Cloud Providers | | Cost and Usage Data Ingestion | | Data Storage and Processing | | (AWS, Azure, GCP) | | (API, Webhooks) | | (Data Lake, Database) | +--------+--------+-----+ +-----------------------+-----------+ +-----------------------+-----------+ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | +-----------------------+ +-----------------------+ | | | | | | | | | | +-----------------------------------+ | | | Cost Optimization Engine | | | | (Recommendations, Automation) | | | +-----------------------------------+ | | | | | | | | | | | | | | | | | | | | +-----------------------------------+ | | | Cost Reporting and Analytics | | | | (Dashboards, Reports) | | | +-----------------------------------+ | | | | | | +---------------------------------------------------------------------------------+ | | | External Systems (Integrations) | | | +---------------------------------------------------------------------------------+ | | | IT Systems (CMDB, Monitoring Tools) ----> Data Storage and Processing | | | | Financial Systems (Accounting, ERP) ----> Data Storage and Processing | | | | Collaboration Tools (Slack, Teams) ----> Cost Optimization Engine, Reporting | | | | BI Tools (Tableau, Power BI) ----> Cost Reporting and Analytics | | | +---------------------------------------------------------------------------------+ | | | | | | | +-----------------------------------------------------------------------------------+ | | +----------------------------------------------------------------------------------------+ | | | +-----------------------------------+ | User Interface | | (Web, Mobile) | +-----------------------------------+

Risk Assessment: Identifying Potential Pitfalls

Making the build vs. buy decision for FinOps tooling involves navigating a landscape of potential risks. A thorough risk assessment is crucial for making an informed choice and proactively mitigating challenges. This section explores the pitfalls associated with both building and buying FinOps solutions, providing actionable strategies to minimize their impact.

Risks of Building FinOps Tooling

Building FinOps tooling from scratch offers customization but comes with inherent risks that can significantly impact project timelines, budget, and overall success.

- Cost Overruns: Developing in-house tooling often leads to unexpected expenses. The initial budget might not account for the full scope of development, ongoing maintenance, and the need for specialized expertise. For example, a company might underestimate the cost of integrating with various cloud providers’ APIs, leading to significant overspending.

- Time Delays: Building FinOps solutions can take longer than anticipated. Delays can arise from complexities in coding, integration challenges, and the need for extensive testing. This can push back the time-to-market, delaying the benefits of effective cost optimization.

- Lack of Expertise: Building FinOps tools requires a team with deep expertise in cloud technologies, data analytics, and FinOps principles. Finding and retaining such talent can be challenging and expensive. Without the right skills, the tools may not accurately reflect the organization’s needs or leverage the latest FinOps best practices.

- Maintenance Burden: In-house tools require ongoing maintenance, including bug fixes, updates, and security patches. This maintenance burden can strain internal resources and divert attention from other critical projects.

- Integration Challenges: Integrating custom-built tools with existing systems and cloud providers can be complex. API changes from cloud providers can require constant adjustments to the tooling, adding to the maintenance overhead.

Mitigating Risks of Building

Several strategies can minimize the risks associated with building FinOps tooling.

- Detailed Planning: Conduct thorough requirements gathering and create a detailed project plan with realistic timelines and budget estimates.

- Phased Approach: Implement a phased approach, starting with a Minimum Viable Product (MVP) to validate the concept and gather user feedback before expanding the scope.

- Talent Acquisition: Invest in recruiting and training the right talent. Consider hiring FinOps consultants or outsourcing specific tasks to gain access to specialized expertise.

- Automation: Automate testing, deployment, and maintenance tasks to reduce manual effort and improve efficiency.

- Open-Source Components: Leverage open-source libraries and frameworks to accelerate development and reduce costs. Ensure proper licensing and compatibility with the organization’s needs.

Risks of Buying FinOps Tooling

Purchasing a third-party FinOps solution also presents potential risks. While often faster and less resource-intensive than building, it’s essential to carefully evaluate the vendor and the solution.

- Vendor Lock-in: Choosing a specific vendor can create vendor lock-in, making it difficult to switch providers later. This can limit flexibility and increase costs if the vendor raises prices or fails to meet evolving needs.

- Integration Issues: Integrating the chosen tool with existing systems and cloud providers might be challenging. The tool may not seamlessly integrate with all the organization’s infrastructure.

- Limited Customization: Purchased tools might offer limited customization options, which can hinder the ability to tailor the solution to specific business requirements.

- Data Security Concerns: Sharing sensitive cost and usage data with a third-party vendor raises data security concerns. Ensuring the vendor has robust security measures and complies with relevant regulations is critical.

- Cost of Ownership: The total cost of ownership (TCO) of a purchased tool might be higher than anticipated, especially when considering subscription fees, implementation costs, and ongoing support expenses.

Mitigating Risks of Buying

Effective strategies can help to mitigate the risks associated with buying FinOps tooling.

- Thorough Vendor Evaluation: Conduct a thorough evaluation of potential vendors, including their financial stability, customer reviews, and security practices.

- Pilot Program: Run a pilot program to test the tool’s functionality, integration capabilities, and ease of use before making a full-scale deployment.

- Negotiate Contracts: Negotiate favorable contract terms, including clear service level agreements (SLAs), data ownership clauses, and exit strategies.

- Data Security Measures: Implement robust data security measures, such as data encryption, access controls, and regular security audits.

- Integration Planning: Develop a detailed integration plan to ensure the tool integrates seamlessly with existing systems.

Risk Assessment Checklist for Build vs. Buy Decisions

This checklist provides a structured approach to assess and manage risks related to the build vs. buy decision for FinOps tooling.

- Define Requirements:

- Clearly define FinOps tooling requirements, including features, integrations, and performance expectations.

- Assess Build Risks:

- Estimate development costs, timelines, and resource requirements.

- Evaluate the availability of internal expertise and skills.

- Assess the potential for cost overruns and delays.

- Consider the long-term maintenance burden.

- Assess Buy Risks:

- Evaluate vendor stability, reputation, and customer reviews.

- Assess integration capabilities with existing systems.

- Review the tool’s customization options.

- Evaluate data security and privacy measures.

- Calculate the total cost of ownership (TCO).

- Compare Options:

- Compare the risks and benefits of building versus buying.

- Develop a risk mitigation plan for the chosen option.

- Consider a hybrid approach (e.g., building specific features and buying others).

- Implement and Monitor:

- Implement the chosen solution.

- Continuously monitor performance, costs, and risks.

- Regularly review and update the risk mitigation plan.

Summary

In conclusion, the build vs. buy decision for FinOps tooling is a multifaceted one, demanding a thorough evaluation of your specific needs, resources, and strategic goals. Whether you choose to build, buy, or adopt a hybrid approach, the key lies in a deep understanding of your cloud environment and a commitment to continuous optimization. By carefully weighing the factors discussed, you can equip your organization with the right tools to effectively manage cloud costs and drive business value.

Helpful Answers

What are the primary benefits of building FinOps tooling?

Building allows for tailored solutions, complete control over features, and the potential to integrate seamlessly with existing systems. It can also provide a competitive advantage by addressing unique business needs.

What are the main advantages of buying pre-built FinOps solutions?

Buying offers faster implementation, reduced upfront costs, access to specialized expertise, and ongoing support and updates from the vendor. It can also free up internal resources.

How do I determine the right approach for my organization?

Consider your internal expertise, budget, time constraints, and specific requirements. Conduct a thorough TCO analysis, evaluate the available vendor solutions, and assess your long-term strategic goals.

What are the biggest risks associated with building FinOps tooling?

The biggest risks include underestimating the complexity, resource drain, ongoing maintenance costs, and the potential for the tool to become outdated or ineffective without dedicated ongoing development.